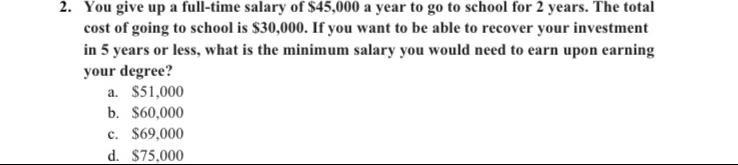

As you give up a full time salary of 45000 takes center stage, this opening passage beckons readers with gaya akademik dengan tone otoritatif into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Exploring the potential financial implications and lifestyle adjustments associated with giving up a full-time salary of $45,000, this comprehensive guide delves into the intricacies of this significant decision. By assessing your current expenses, researching alternative career paths, and evaluating your spending habits, you can navigate this transition with confidence and make an informed choice that aligns with your financial goals and personal aspirations.

Financial Implications

Giving up a full-time salary of $45,000 can significantly impact your financial situation. Assess your current expenses and adjust your budget accordingly. Consider strategies like reducing discretionary spending, negotiating lower bills, and seeking additional income sources.

Expense Reduction

- Review spending habits and identify areas for cuts.

- Negotiate lower rates on bills like rent, utilities, and insurance.

- Explore cost-saving alternatives for entertainment, dining, and transportation.

Income Generation

- Consider part-time work or freelance projects to supplement your income.

- Explore passive income streams like investing or renting out a portion of your home.

- Utilize government assistance programs or non-profit organizations for financial support if eligible.

Career Considerations

Explore alternative career paths that offer flexibility or comparable income potential. Research different industries and job roles. Network with professionals in your field and develop new skills to enhance your career prospects.

Career Exploration

- Research alternative career paths that align with your interests and skills.

- Attend industry events and network with professionals to gain insights.

- Identify job roles that offer flexibility, remote work options, or entrepreneurial opportunities.

Skill Development

- Enroll in courses or workshops to acquire new skills and certifications.

- Seek mentorship or apprenticeship opportunities to gain practical experience.

- Utilize online resources and platforms to enhance your knowledge and skills.

Lifestyle Changes

Giving up a full-time salary may necessitate lifestyle adjustments. Evaluate your spending habits and prioritize expenses. Consider reducing discretionary spending, downsizing your living space, or exploring shared housing options.

Spending Evaluation

- Track your expenses to identify areas where you can reduce spending.

- Prioritize essential expenses such as housing, food, and healthcare.

- Consider cutting back on non-essential expenses like entertainment and dining out.

Housing Adjustments

- Explore downsizing to a smaller or more affordable living space.

- Consider shared housing arrangements to reduce housing costs.

- Negotiate lower rent or explore government housing assistance programs.

Emotional Impact

Giving up a full-time salary can evoke emotional challenges. Acknowledge and address feelings of uncertainty and financial stress. Seek support from family, friends, or financial advisors to navigate this transition.

Emotional Management

- Acknowledge and validate your emotions related to the financial transition.

- Seek support from trusted individuals who can provide emotional encouragement.

- Practice self-care activities such as exercise, meditation, or spending time in nature.

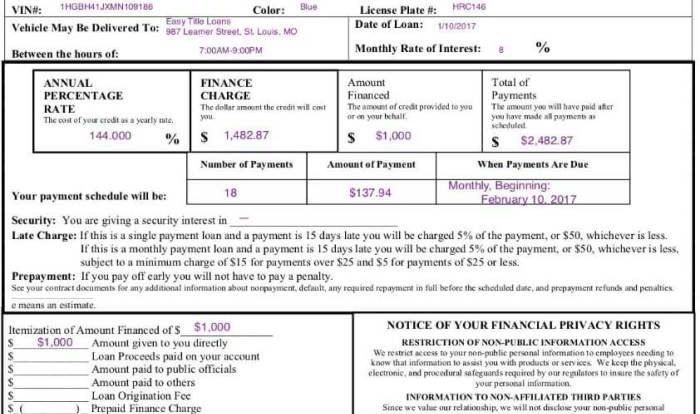

Financial Counseling, You give up a full time salary of 45000

- Consider consulting a financial advisor for professional guidance and support.

- Explore non-profit organizations or government programs that offer financial counseling services.

- Utilize online resources and tools to manage your finances and reduce stress.

Risk Assessment

Assess your financial situation and risk tolerance before giving up a full-time salary. Identify potential risks and develop strategies to mitigate them. Consider creating a financial plan that addresses these risks.

Financial Assessment

- Evaluate your assets, liabilities, and cash flow to determine your financial health.

- Assess your risk tolerance and willingness to take on financial uncertainty.

- Identify potential risks associated with giving up a stable income source.

Risk Mitigation

- Create a financial plan that Artikels strategies to manage risks.

- Consider insurance policies to protect against unforeseen events.

- Establish an emergency fund to cover unexpected expenses.

Decision-Making Process

Make an informed decision about whether or not to give up a full-time salary by considering both financial and non-financial factors. Weigh the pros and cons carefully and seek guidance from trusted sources.

Pros and Cons

| Pros | Cons |

|---|---|

| Flexibility and autonomy | Reduced income and benefits |

| Potential for higher earning potential | Job insecurity and instability |

| Improved work-life balance | Increased financial stress |

Guidance and Support

- Seek advice from trusted family, friends, or financial advisors.

- Attend workshops or seminars on financial planning and decision-making.

- Utilize online resources and tools to gather information and make informed choices.

FAQ Explained: You Give Up A Full Time Salary Of 45000

What are the key financial considerations when giving up a full-time salary?

Assessing your current expenses, adjusting your budget, and exploring strategies for managing finances effectively with a reduced income are crucial financial considerations.

How can I explore alternative career paths with comparable income potential?

Researching different industries, job roles, networking, and developing new skills can help you identify alternative career paths that offer flexibility or income potential comparable to a full-time salary.

What lifestyle adjustments may be necessary when giving up a full-time salary?

Evaluating spending habits, prioritizing expenses, and implementing tips for reducing expenses and maximizing savings can help you make necessary lifestyle adjustments to accommodate a reduced income.