Ngpf impact of credit score on loans answer key – NGPF Impact of Credit Score on Loans: Answer Key delves into the intricate relationship between credit scores and loan terms, providing a comprehensive guide to understanding how your credit history influences your borrowing power. This essential resource empowers you with the knowledge to navigate the loan application process confidently and make informed financial decisions.

Throughout this guide, we will explore the key factors that shape your credit score, its significance in loan approval, and effective strategies for building and maintaining a strong credit profile. Real-world case studies and practical examples will illustrate the tangible impact of credit scores on loan applications, equipping you with the insights you need to optimize your financial well-being.

Impact of Credit Score on Loans

A credit score is a numerical representation of an individual’s creditworthiness, calculated based on their financial history. It plays a pivotal role in the loan application process, influencing the terms and conditions of the loan.

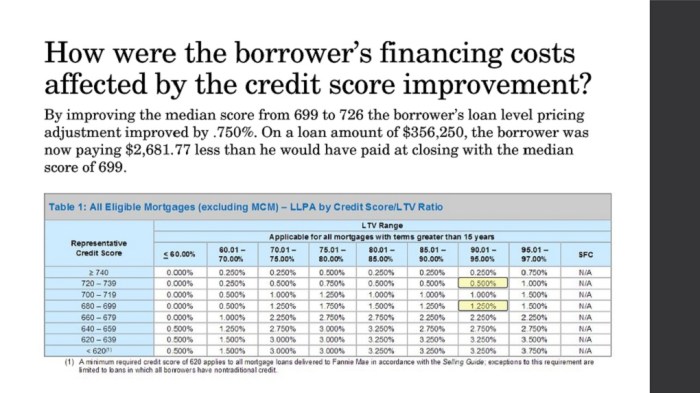

Credit Score Impact on Loan Terms

A high credit score can lead to favorable loan terms, including:

- Lower interest rates

- Longer loan terms

- Higher loan amounts

Conversely, a low credit score can result in less favorable loan terms, such as:

- Higher interest rates

- Shorter loan terms

- Lower loan amounts

Factors Influencing Credit Score

Several key factors affect a credit score, including:

- Payment history

- Amounts owed

- Length of credit history

- New credit inquiries

- Credit mix

Positive actions that can improve a credit score include:

- Making on-time payments

- Keeping credit utilization low

- Building a long credit history

- Limiting new credit inquiries

- Maintaining a diverse credit mix

Negative actions that can damage a credit score include:

- Missing or late payments

- Using too much available credit

- Opening multiple new credit accounts in a short period

- Having too much debt

- Filing for bankruptcy

Importance of Credit Score in Loan Approval

A credit score is crucial in the loan approval process because it:

- Determines whether the loan application will be approved or denied

- Influences the loan terms, including interest rate and loan amount

- Provides lenders with an assessment of the borrower’s risk

Different types of loans have varying minimum credit score requirements, with higher credit scores generally leading to more favorable loan terms.

Strategies for Improving Credit Score, Ngpf impact of credit score on loans answer key

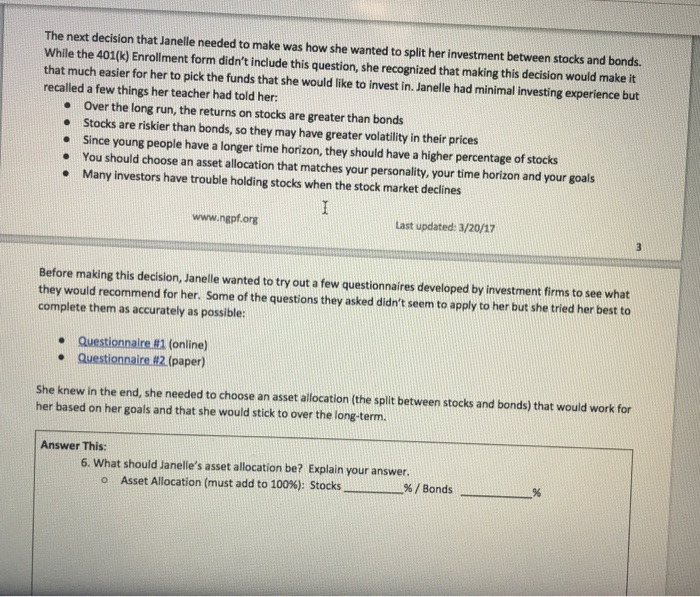

Individuals can take steps to build a good credit score or recover from a poor one:

- Pay bills on time, every time

- Keep credit utilization below 30%

- Limit new credit inquiries

- Build a long and positive credit history

- Dispute any errors on credit reports

- Seek credit counseling if needed

Long-Term Implications of Credit Score

Maintaining a good credit score has long-term benefits, including:

- Lower interest rates on loans and credit cards

- Access to better credit terms

- Higher chances of loan approval

- Improved financial stability

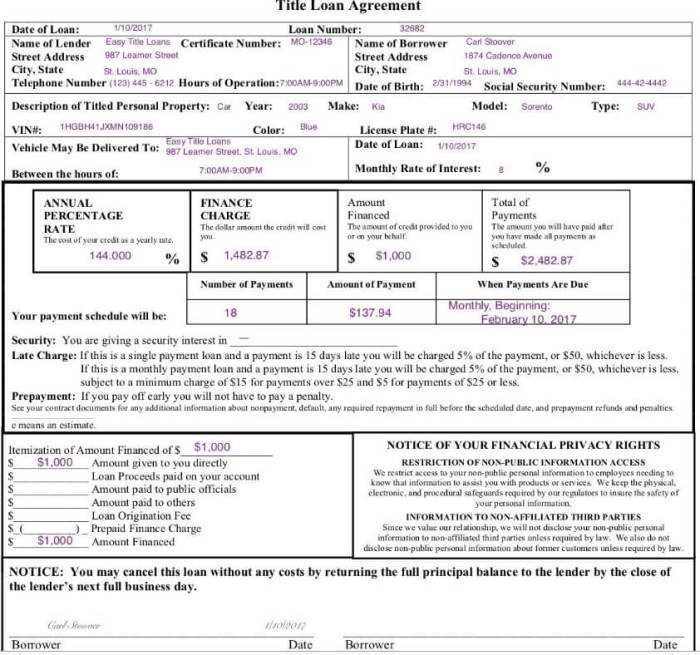

Case Studies: Credit Score Impact on Loan Applications

Case Study 1:

| Credit Score | Loan Amount | Interest Rate |

|---|---|---|

| 750 | $200,000 | 3.5% |

| 650 | $150,000 | 4.5% |

| 550 | $100,000 | 6.0% |

Case Study 2:

- Applicant A with a credit score of 800 was approved for a mortgage with an interest rate of 2.75%.

- Applicant B with a credit score of 600 was approved for the same mortgage but with an interest rate of 4.25%.

FAQ Summary: Ngpf Impact Of Credit Score On Loans Answer Key

What is the minimum credit score required for a personal loan?

The minimum credit score requirement for a personal loan varies depending on the lender and the loan amount. Generally, a score of 650 or higher is considered good and can qualify you for the most favorable loan terms.

How can I improve my credit score?

To improve your credit score, make all payments on time, keep your credit utilization low, and avoid opening too many new credit accounts in a short period.

What is the impact of a low credit score on loan interest rates?

A low credit score can lead to higher interest rates on loans, making it more expensive to borrow money. Lenders view borrowers with low credit scores as higher risk, and they compensate for this risk by charging higher interest rates.