Adjust the percentages of chris’ investments answer – Adjusting the percentages of Chris’s investments is a crucial step in ensuring that his portfolio aligns with his financial goals, risk tolerance, and market conditions. This comprehensive guide delves into the factors to consider, asset class analysis, rebalancing strategies, tax implications, and implementation plans involved in making informed investment adjustments.

By carefully evaluating the current distribution of Chris’s investments and considering the impact of market conditions, risk tolerance, and financial goals, we can develop a tailored investment strategy that meets his specific needs.

1. Investment Portfolio Overview

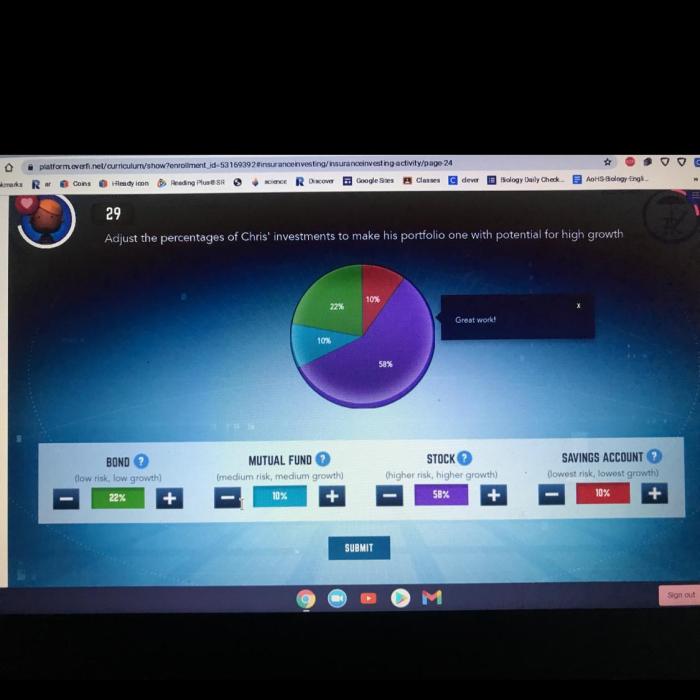

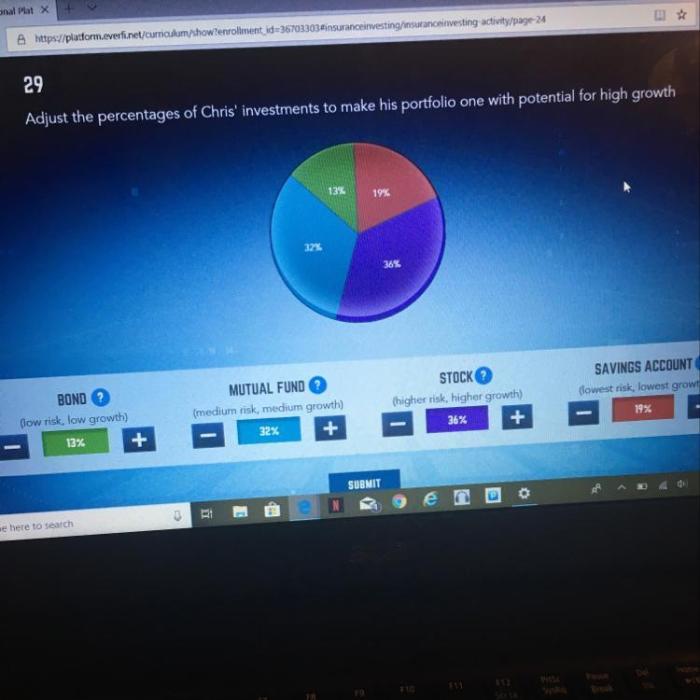

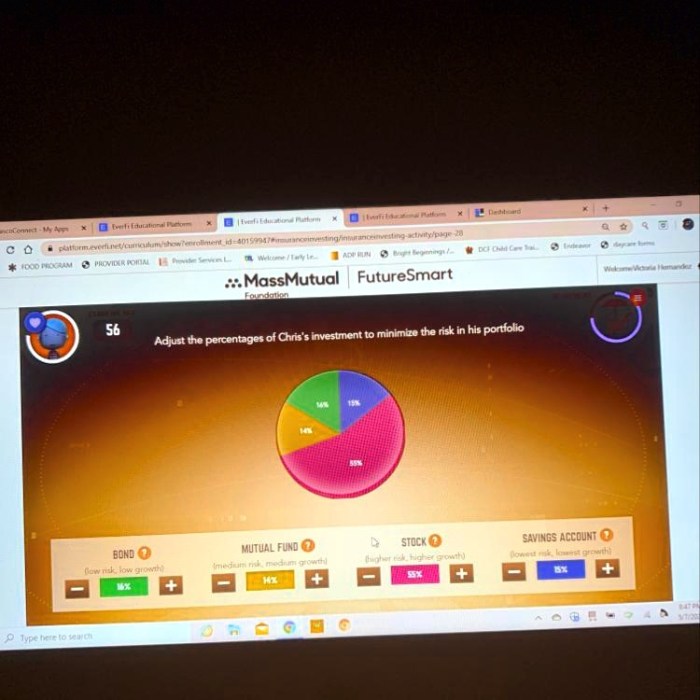

Chris’s current investment portfolio is diversified across various asset classes. The table below summarizes the current percentages allocated to each asset class:

| Asset Class | Percentage |

|---|---|

| Stocks | 55% |

| Bonds | 30% |

| Cash | 15% |

2. Factors to Consider for Adjustment: Adjust The Percentages Of Chris’ Investments Answer

Chris may need to adjust his investment percentages for various reasons. These include changes in market conditions, his risk tolerance, and his financial goals.

Market Conditions

Market conditions can significantly impact investment decisions. For example, if the stock market is expected to perform well, Chris may consider increasing his stock allocation. Conversely, if the bond market is expected to perform poorly, he may consider reducing his bond allocation.

Risk Tolerance

Chris’s risk tolerance is another important factor to consider. If he is more risk-averse, he may prefer to allocate a larger portion of his portfolio to bonds and cash. If he is more risk-tolerant, he may prefer to allocate a larger portion to stocks.

Financial Goals, Adjust the percentages of chris’ investments answer

Chris’s financial goals should also be considered when adjusting his investment percentages. For example, if he is saving for retirement, he may prefer to allocate a larger portion of his portfolio to stocks, which have the potential for higher returns over the long term.

If he is saving for a short-term goal, he may prefer to allocate a larger portion to cash or bonds, which have lower risk and lower potential returns.

FAQ Explained

What are the key factors to consider when adjusting investment percentages?

Market conditions, risk tolerance, financial goals, time horizon, and tax implications.

What are the different asset classes available to investors?

Stocks, bonds, cash, real estate, and commodities.

What are the benefits of rebalancing an investment portfolio?

Maintaining desired risk levels, capturing market opportunities, and reducing portfolio volatility.