Gideon company uses the allowance method of accounting for uncollectible – Gideon Company’s adoption of the allowance method for accounting for uncollectible accounts serves as a compelling case study, illuminating the intricacies of this accounting technique and its impact on financial reporting. This article delves into the nuances of Gideon Company’s implementation, examining the methods employed to estimate uncollectible accounts, record uncollectible accounts expense, and write off uncollectible accounts, all while analyzing the subsequent effects on the company’s financial statements.

The allowance method offers a comprehensive approach to accounting for uncollectible accounts, providing a reliable estimate of bad debt expense and ensuring accurate financial reporting. Gideon Company’s utilization of this method exemplifies the practical application of accounting principles, showcasing its effectiveness in managing credit risk and maintaining financial health.

Allowance Method of Accounting for Uncollectible Accounts: Gideon Company Uses The Allowance Method Of Accounting For Uncollectible

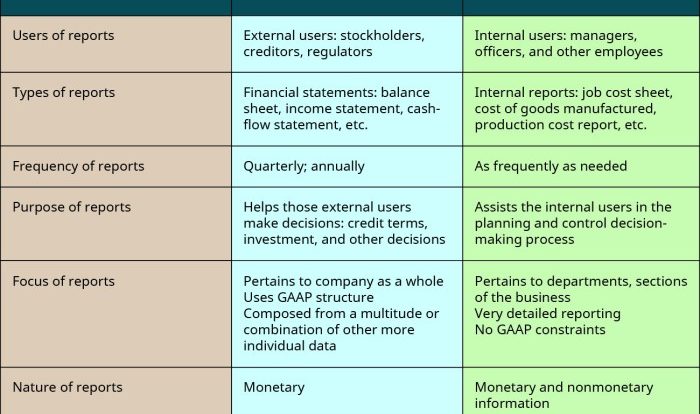

The allowance method of accounting for uncollectible accounts is a technique used to estimate and record the amount of uncollectible accounts expense in a given period. This method involves creating an allowance for doubtful accounts, which is a contra-asset account that reduces the balance of accounts receivable to reflect the estimated amount of uncollectible accounts.

Gideon Company uses the allowance method to ensure accurate financial reporting and to provide a more realistic view of its financial position.

Estimating Uncollectible Accounts, Gideon company uses the allowance method of accounting for uncollectible

Gideon Company uses several methods to estimate uncollectible accounts:

-

-*Historical data

Gideon Company analyzes historical data on bad debt write-offs to determine the average percentage of accounts receivable that become uncollectible. This percentage is then used to estimate the allowance for doubtful accounts.

-*Aging of accounts receivable

Gideon Company ages its accounts receivable to determine the likelihood of collection. Accounts that are overdue by a certain number of days are considered more likely to be uncollectible and are assigned a higher percentage for the allowance.

-*Other factors

Gideon Company also considers other factors when estimating uncollectible accounts, such as the creditworthiness of customers, the economic climate, and industry trends.

FAQ Corner

What is the allowance method for uncollectible accounts?

The allowance method is an accounting technique used to estimate and record uncollectible accounts, providing a more accurate representation of a company’s financial position.

How does Gideon Company estimate uncollectible accounts?

Gideon Company employs various methods to estimate uncollectible accounts, including the aging of accounts receivable and the consideration of historical data and industry benchmarks.

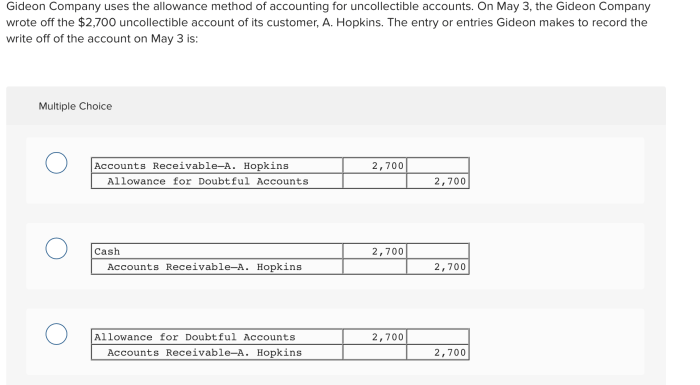

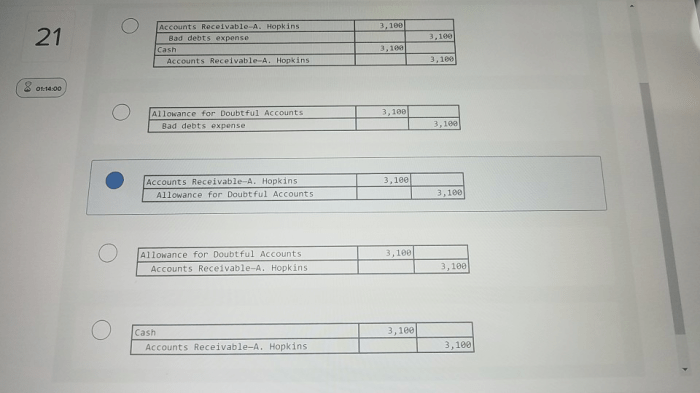

What is the impact of writing off uncollectible accounts on Gideon Company’s financial statements?

Writing off uncollectible accounts reduces the company’s accounts receivable and increases its bad debt expense, which can impact its net income and overall financial performance.